How to Start a Legal Firm The Definitive Guide

So, you're thinking about hanging your own shingle. It's a powerful dream, but turning that vision into a successful law practice means starting with a solid strategic plan. Before you even think about fancy office space or a slick website, you have to lay the groundwork.

This initial phase isn't just about checking boxes. It’s about making the tough, critical decisions that will define your firm's identity, its profitability, and where it's headed in the long run.

A great law firm is built on more than just great lawyering. It's built on a crystal-clear understanding of the market, a compelling reason for clients to choose you, and a realistic financial map. Skipping this stage is one of the most common reasons new firms fizzle out before they even get going.

Identifying Your Niche and Ideal Client

Let's be blunt: the legal market is crowded. Trying to be everything to everyone is a fast track to being overlooked. The most successful new firms I've seen all have one thing in common: they zero in on a specific niche. This focus transforms you from a generalist into a sought-after expert, which makes your marketing infinitely more effective and lets you command better rates.

Think beyond the big, generic practice areas. Instead of just "family law," what about specializing in "high-asset divorce for entrepreneurs"? Instead of "business law," you could carve out a space in "intellectual property for tech startups." See the difference?

To find your sweet spot, ask yourself a few honest questions:

- What legal problems do I genuinely love solving? Your passion will be your fuel during those challenging early days.

- Where are the gaps in my local market? Look for client groups that are underserved or where bigger firms are too slow or expensive to be a good fit.

- What unique experience do I bring to the table? A past career or special credential can be a powerful differentiator.

Once your niche is clear, picture your ideal client. Who are they? What are their biggest headaches? Where do they hang out online and offline? Knowing this allows you to tailor everything—your messaging, your services, your entire approach—to attract exactly the right people.

Defining Your Unique Value Proposition

Okay, you've got your niche. Now, why should a client pick you over the well-established firm down the street? That's your unique value proposition (UVP). It’s a short, clear statement that screams, "Here's the distinct benefit you get with me."

A strong UVP isn't just "I'm a better lawyer." It’s tangible. It could be based on:

- Unmatched client service: Maybe you guarantee a response to all client messages within four hours.

- Modern pricing models: You could offer flat-fee packages or subscription services that give clients predictability beyond the billable hour.

- Smarter technology: Perhaps you use specific tools to deliver results more efficiently and transparently than your competitors.

Your value proposition needs to be the immediate, confident answer to a potential client's question: "Why should I hire you?" If you can't nail that in one or two compelling sentences, it's time to go back to the drawing board.

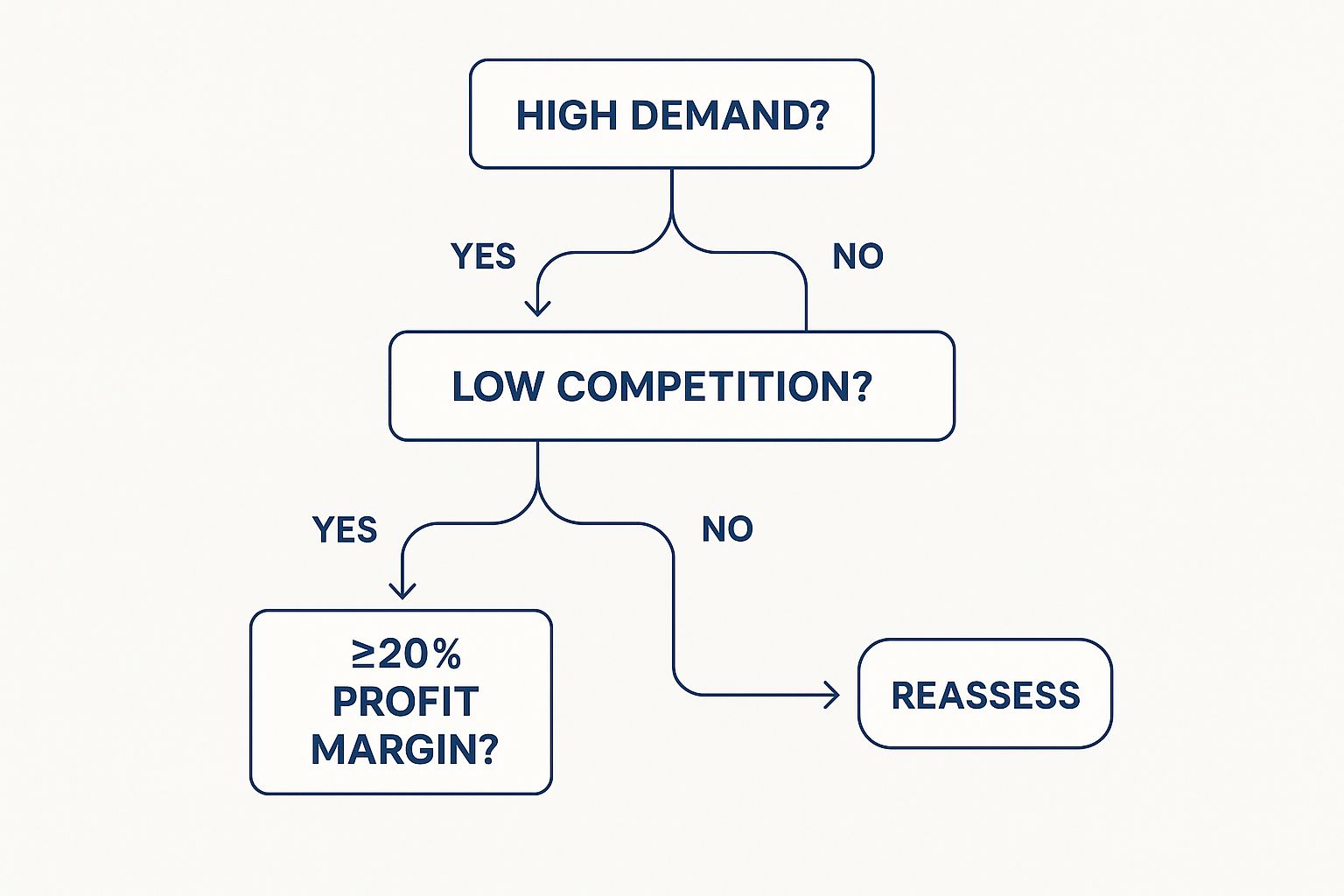

This decision tree gives you a simple framework for weighing potential niches based on demand, competition, and your potential for profit.

Use a visual guide like this to quickly assess whether a practice area is a solid business opportunity or just a pipe dream.

Building Your Financial Projections

Finally, every good blueprint needs a rock-solid financial foundation. This means getting real about your startup costs and your ongoing monthly expenses. You need to know your numbers cold before you open your doors. A classic mistake is underestimating costs while being overly optimistic about how quickly revenue will start rolling in.

Understanding your startup costs is the first step toward building a realistic budget and securing any necessary funding. Below is a breakdown of the typical expenses you should plan for in your first year.

Startup Cost Breakdown for a Solo or Small Firm

| Expense Category | Estimated Cost Range (One-Time) | Estimated Cost Range (Monthly) | Notes & Considerations |

|---|---|---|---|

| Business Formation | $500 - $1,500 | N/A | Varies by state and business structure (LLC, PLLC, etc.). |

| Bar Dues & Licensing | $300 - $1,000 | N/A | Annual or biennial costs. Check your state and local bar associations. |

| Malpractice Insurance | $500 - $3,000 (initial premium) | $150 - $400 | Crucial for protection. Quotes depend on practice area and experience. |

| Office Space & Utilities | $0 - $5,000 | $500 - $4,000 | Can be $0 if starting from home. Costs for a physical office or co-working space vary wildly. |

| Technology & Software | $1,500 - $7,000 | $200 - $800 | Includes computer, printer, phone, and essential software (case management, billing, Whisperit). |

| Website & Marketing | $1,000 - $10,000 | $300 - $1,500+ | Initial website design plus ongoing costs for digital advertising, SEO, and content. |

| Office Supplies | $200 - $800 | $50 - $150 | Basic supplies, stationery, business cards. |

| Contingency Fund | 15-20% of total startup costs | N/A | Your "sleep at night" fund. Don't skip this. |

Remember, these are just estimates. Your actual costs will depend heavily on your location, practice area, and business model. The key is to do your homework and create a budget that gives you a runway for at least 6-12 months with little to no income.

The good news? The legal market is seeing a resurgence in profitability, driven by steady demand and better expense control. A huge factor here is the adoption of AI, which is expected to save legal professionals around 12 hours per week by 2029. To get a head start on boosting your own efficiency, check out our time-saving templates for legal documents. Your business plan should absolutely reflect these industry shifts, showing exactly how you plan to stay competitive and profitable from day one.

Navigating Your Legal Structure and Compliance

Picking your firm’s legal structure is one of those foundational decisions you absolutely have to get right. This isn’t just about filing some paperwork; it’s a choice that dictates your personal liability, how you'll be taxed, and how much flexibility you have to grow, bring on partners, or even get funding later. Nail this from the start, and you’re building on solid ground.

It's easy to get bogged down in the options, but the decision really comes down to what you're trying to build. Are you hanging out a shingle as a solo practitioner on a shoestring budget? Or are you launching with a few partners right out of the gate? Each path has a structure that makes the most sense.

A solo attorney, for instance, might be tempted by the simplicity of a sole proprietorship. It's cheap and easy. The huge downside? There's absolutely no liability protection. Your personal assets—your house, your car, your savings—are on the line if the firm gets sued. That’s a massive risk most lawyers just aren't willing to take, and for good reason.

Choosing Your Business Entity

For most new law firms, the conversation quickly narrows down to a few key choices that offer the liability protection you need. Let's walk through the most common ones.

A Professional Limited Liability Company (PLLC) is a go-to for many lawyers. It creates a firewall between your business debts and your personal assets, which is non-negotiable in our field. Just remember, while it protects you from the firm's general liabilities, it won't shield you from your own professional malpractice.

If you're launching with co-founders, a Partnership is often the way to go, typically a Limited Liability Partnership (LLP). This structure is built for multiple owners and, much like a PLLC, protects your personal assets from the business's debts and, crucially, from the malpractice of your partners.

The right structure aligns with your risk tolerance and growth strategy. A solo practitioner aiming for simplicity might favor a single-member PLLC, while a team of founders will need the clear governance of an LLP or multi-member PLLC.

To really dig into the financial side of things, it’s worth comparing the tax and liability implications. For a deeper look, this guide on S Corp vs. LLC for small businesses is a fantastic resource for clarifying the nuances that will hit your bottom line.

Mastering Essential Compliance Steps

Once you've locked in your entity, the real administrative fun begins. Compliance isn’t a one-and-done checkbox; it’s an ongoing responsibility that protects your firm, your clients, and your license to practice. Dropping the ball here can lead to serious ethical trouble and painful financial penalties.

At a minimum, your initial compliance checklist needs to cover these bases:

- Register Your Firm Name: Before you fall in love with a name, make sure it clears state bar rules and isn’t already taken. Then, get it officially registered with the state and any local authorities.

- Obtain a Federal Tax ID Number (EIN): You'll need an Employer Identification Number from the IRS for almost everything—opening business bank accounts, hiring staff, and filing taxes.

- Open Dedicated Bank Accounts: This is a bright-line rule: never, ever co-mingle business and personal funds. Open a dedicated business operating account for all firm expenses and revenue.

- Establish an IOLTA Account: An Interest on Lawyers' Trust Account (IOLTA) isn't optional; it's a legal requirement for holding client funds like retainers or settlement money. Mishandling client funds is one of the quickest paths to disciplinary action.

Think of these steps as the absolute floor. You’ll also need to get the right state, county, and city business licenses to operate legally. To make sure nothing falls through the cracks, our compliance audit checklist provides a clear, structured guide.

Securing Malpractice Insurance

Last but certainly not least, do not even think about serving a single client without professional liability insurance. This is your ultimate safety net, often called malpractice insurance. It’s what protects you and your new firm from claims of negligence or mistakes in your legal work.

How much coverage you need will depend on your practice area. High-stakes litigation, for example, demands a much higher policy limit than simple transactional work. This isn't the place to cut corners by picking the cheapest plan. Scrutinize the policy limits, deductibles, and exclusions to make sure you have solid protection from the moment you open your doors.

Building Your Modern Technology Stack

Let’s be honest: in today's legal world, your technology is just as important as your legal knowledge. It’s not some fancy add-on anymore; it's the engine that drives your entire practice. For a new firm, making smart tech choices right from the start is one of the most critical decisions you'll make. It’s how you build an efficient operation that can go toe-to-toe with bigger, more established firms from day one.

A well-planned tech stack takes the administrative headache out of running a firm, keeps your client data locked down tight, and, most importantly, frees up your time. This means you can focus on what you're actually good at—practicing law and bringing in new clients—instead of getting lost in a sea of paperwork.

Core Components of Your Legal Tech Stack

When you're just starting, you don't need every shiny new gadget on the market. The key is to focus on the foundational tools that will form the backbone of your practice. Think of these as your non-negotiables.

Your first and most important investment is Practice Management Software (PMS). This is the central hub for your entire firm. A good PMS like Clio, PracticePanther, or MyCase brings together your client intake, case files, calendar, deadlines, and communications into one clean dashboard. It’s what stops important details from slipping through the cracks.

Next up, you need a solid Billing and Accounting System. While some PMS platforms include billing features, a dedicated tool like QuickBooks Online is often more powerful for managing your firm’s finances. Getting paid on time is what keeps the lights on, and automating your billing process cuts down on errors and seriously improves cash flow. In fact, a recent study showed 74% of law firms see automating manual tasks as their biggest opportunity for efficiency.

Finally, a secure Document Management System (DMS) is absolutely essential. You’re handling incredibly sensitive client information, so a cloud-based DMS is a must. It gives you a secure, organized place for all your files that you can access from anywhere, making it easy to collaborate with clients or co-counsel without compromising security.

The Strategic Advantage of AI-Powered Tools

Once you have the basics covered, integrating AI-powered tools is what will really give you an edge. The legal tech world is booming with innovation right now, and most of it is driven by AI’s ability to handle complex tasks that used to eat up hours of your day. This isn't just a fleeting trend; it’s a fundamental shift in how legal work is done.

The rise of legal AI isn't about replacing lawyers. It's about augmenting them, allowing a small firm to punch far above its weight by handling complex research, drafting, and analysis with unprecedented speed and accuracy.

Just look where the money is going. In early 2025, U.S. legal tech funding exploded, with AI platforms getting the lion's share of the investment. For example, the AI legal platform Harvey brought in a massive $300 million** funding round, while others like SpotDraft and EvenUp raised **$54 million and $135 million, respectively. This influx of cash is fueling powerful new tools that are accessible to firms of any size.

For a new firm, this is a game-changer. A tool like Whisperit can completely transform your daily workflow. Just imagine using AI to:

- Draft documents faster: Generate initial drafts of letters, motions, and contracts from a few voice commands.

- Speed up legal research: Pinpoint relevant case law and statutes without spending half your day buried in a database.

- Summarize complex information: Get the key takeaways from a long deposition or discovery dump in minutes.

Building these capabilities into your practice from the start gives you a serious competitive advantage. You can offer faster, more responsive service and more competitive pricing, which is exactly what clients are looking for. For a deeper dive into these options, check out our guide on essential law firm technology to help you choose wisely.

Essential Legal Tech Tool Comparison

Choosing the right software can feel overwhelming with so many options out there. This table breaks down the core categories to help you compare and decide what's best for your new firm's needs and budget.

| Tool Category | Key Features to Look For | Top Provider Examples | Pricing Model |

|---|---|---|---|

| Practice Management Software (PMS) | Case management, calendaring, client portal, task automation, conflict checking | Clio, PracticePanther, MyCase | Per user, per month subscription |

| Billing & Accounting | Time tracking, invoicing, trust accounting, payment processing, financial reporting | QuickBooks Online, LawPay, Xero | Monthly subscription |

| Document Management (DMS) | Secure cloud storage, version control, full-text search, e-signatures, collaboration tools | NetDocuments, iManage, Google Drive | Per user/storage tier subscription |

| AI-Powered Tools | Document drafting/review, legal research, case summary, e-discovery analysis | Whisperit, Harvey, Casetext | Subscription or usage-based |

Ultimately, the best tools are the ones that integrate well with each other and fit seamlessly into your workflow. Don't be afraid to take advantage of free trials to see what feels right before you commit.

Winning Your First Clients and Building Momentum

You've laid the groundwork and handled the legalities, but a law firm isn't really a firm without clients. Landing those first few cases is, for many new firm owners, the most intimidating part of the journey. This is the moment your sharp legal mind has to embrace sales and marketing—a pivot that can honestly make or break a new practice.

The good news? You don't need a huge marketing budget to get the ball rolling. What you do need is a smart strategy, consistency, and a genuine focus on building relationships that showcase your expertise. Early momentum is built one client at a time, creating a ripple effect that eventually grows into a steady stream of work.

Building Your Digital Storefront

Let’s be clear: your website is your modern-day storefront. For most potential clients, it's the very first impression they'll have of your firm. It has to look professional, feel trustworthy, and be dead simple to navigate. Think of it less like a static brochure and more as an active client-generation machine.

A truly effective legal website does a few key things really well:

- It immediately answers "who do you help and how?": A visitor shouldn't have to guess. Your niche and value should be obvious within seconds.

- It's built for local search: This means weaving in keywords that reflect your practice area and location (like "family law attorney in Austin"). This is how local clients find you on Google.

- It has a clear call to action: Make it incredibly easy for people to take the next step, whether that's filling out a form, seeing a prominent phone number, or clicking a "schedule a consultation" button.

- It showcases your expertise: This is where content comes in.

The Power of Content Marketing

Blogging is one of the most powerful tools you have for establishing authority. The 2023 ABA TechReport found that about one-third of law firms have a blog, and of those, 34% say it has directly resulted in client retention. It’s a proven method for demonstrating your knowledge and building trust before you ever speak to a potential client.

Forget writing about broad, academic legal topics. Instead, focus on answering the specific, urgent questions your ideal clients are typing into Google. A real estate lawyer, for instance, could write a killer post on "Common Mistakes First-Time Homebuyers Make in Florida." This approach doesn't just attract traffic; it attracts qualified leads who see you as an expert.

The goal of your blog isn't just to rank on Google; it's to build authority and trust. By answering your clients' most pressing questions, you become a valuable resource, making them far more likely to hire you when they need legal help.

For any new firm, mastering proven digital strategies to get more legal clients is the key to creating consistent, predictable growth.

Networking and Referral Relationships

While your digital presence is vital, don't ever discount the power of old-fashioned networking. Referrals are still the lifeblood of most successful law practices. Your mission is to cultivate a strong network of professionals who can confidently send business your way.

And that network should extend far beyond other lawyers. Think about the other professionals who are already serving your ideal clients.

- If you're a business lawyer, get to know accountants, financial advisors, and commercial real estate agents.

- If you're a family lawyer, build connections with therapists, counselors, and even school administrators.

Show up at local business events, get involved with your local bar association committees, and be a real person on professional platforms like LinkedIn. The secret is to focus on genuine relationships, not just collecting business cards. Always look for ways to offer value first—share a referral, provide a quick insight, and become a resource for others.

Once you start bringing in those first clients, your focus has to shift to delivering an incredible experience. A seamless onboarding process is absolutely critical for setting the right tone and turning that new client into a future referral source. For a deep dive on getting this right, check out our guide on perfecting the https://www.whisperit.ai/blog/client-intake-process. Building this system is every bit as important as your marketing for creating long-term momentum.

Managing Your Firm's Finances for Lasting Success

Winning cases is what gets you noticed, but smart financial management is what keeps your doors open for the long haul. When you're figuring out how to start a legal firm, getting your financial house in order from day one isn't just a good idea—it's essential. This discipline is what will carry you through lean months, fund your growth, and ultimately build a practice that can stand the test of time.

Your first big financial decision? Setting your rates. This isn't just about pulling a number out of thin air. It's a strategic move that reflects your value, defines your brand, and attracts the right kind of clients. While the billable hour is still a mainstay, many modern firms are getting creative and winning clients over with more predictable pricing.

What’s the Right Billing Model for You?

Rethinking how you charge for your services can give you a serious leg up on the competition. Clients today crave predictability, and moving away from the ticking clock of hourly billing is a powerful way to provide it.

- Flat-Fee Billing: This is a fantastic option for services with a clear start and end point. Think simple will drafting, uncontested divorces, or standard real estate closings. You name a price, the client agrees, and everyone knows exactly what to expect.

- Subscription Services: If you're serving business clients who need regular legal guidance, this model is a game-changer. They pay a set monthly fee for access to your expertise, which gives them peace of mind and provides your firm with predictable, recurring revenue.

- Hybrid Models: Don't be afraid to mix and match. You could combine a lower hourly rate with a success fee tied to the outcome, or charge a flat fee for the initial discovery phase of litigation before switching to an hourly rate for the more unpredictable trial work.

Having this kind of flexibility allows you to align your pricing with what your clients actually need and the nature of the work itself. It makes your firm far more appealing and your income streams much more reliable.

The Non-Negotiables of Law Firm Accounting

Clean books are the foundation of any profitable and compliant law practice. From the moment you open for business, you absolutely must have two separate bank accounts: your operating account and your trust account (IOLTA).

Think of it this way: the operating account is for your money—all the firm's revenue and expenses. It's what you use to pay for software, rent, and your own salary. The IOLTA (Interest on Lawyers' Trust Account), on the other hand, is sacred ground. It holds your clients' money, like retainers or settlement funds, and it should never be touched for firm expenses. Co-mingling these funds is one of the fastest ways to land in serious ethical hot water, so strict separation is non-negotiable. Many modern practice management solutions can help automate this process to prevent a simple mistake from becoming a major disaster.

Financial discipline isn’t about restriction; it’s about freedom. When you have a crystal-clear, real-time view of your firm’s finances, you can make bold, strategic decisions with confidence instead of just reacting out of fear.

Keep Your Eyes on the Right Numbers

You can't improve what you don't measure. By tracking just a few Key Performance Indicators (KPIs), you can get a quick, accurate pulse on your firm's financial health and catch potential problems before they spiral out of control.

Here are the essential metrics you should be watching:

- Realization Rate: This tells you what percentage of the time you record actually makes it onto an invoice. If this number is low, it's a red flag that you might be writing off too much of your valuable time.

- Collection Rate: This is the percentage of your invoiced bills that you actually get paid. A poor collection rate points to an issue in your billing process or your follow-up with clients.

- Profit Margin: The classic bottom line. It's your net income divided by your revenue, and it simply tells you how much profit you're making for every dollar that comes in the door.

Keeping a close eye on these numbers is how you build a truly profitable business. And the potential is huge. Look at Sprintlaw, an Australian firm focused on startups, which grew its annual revenue to $2.97 million**—an 8.4% increase. Or consider Elemental CoSec, a hybrid legal and accounting service, which saw its revenue explode by 205% over three years to nearly **$7.9 million. As you can see from the growth in specialized legal providers at Gaps.com, these examples prove that when you combine a sharp focus on your niche with disciplined financial oversight, incredible growth is possible.

Common Questions When Starting a Firm

Taking the leap to start your own law firm is a huge step—equal parts thrilling and terrifying. As you start mapping things out, you’ll find the same questions pop up again and again, covering everything from money to finding those crucial first clients. Getting solid answers to these early-stage hurdles is what gives you the confidence to actually pull the trigger.

Let's dive into some of the most common questions I hear from lawyers on the verge of launching their own practice. These aren't textbook answers; they're based on what works (and what doesn't) in the real world.

How Much Capital Do I Really Need to Start?

The honest-to-goodness answer? It completely depends on the kind of firm you're building. A lot of lawyers assume they need a massive bank loan, but that's not always the case. Plenty of successful firms have gotten off the ground with a surprisingly small amount of cash.

For a solo lawyer running a virtual practice, you could realistically launch for as little as $5,000 to $10,000. That'll cover the bare-bones essentials: malpractice insurance, your business entity registration, a decent website, and a few core software subscriptions. It's the classic bootstrap approach—you keep your overhead incredibly low, which minimizes your risk right out of the gate.

On the other hand, if you’re planning to open a physical office and hire an assistant from day one, you're playing a different ballgame. For that kind of setup, you’ll need a much bigger war chest. Expect startup costs to be somewhere in the $30,000 to $75,000 range, or even higher depending on your city and how ambitious your plans are.

Here’s the most important financial advice I can give you: it's not about the total amount you have in the bank. It's about having enough of a runway. You absolutely must budget for at least six months of living and operating expenses to see you through that initial ramp-up period before the client work becomes consistent.

What Is the Most Common Mistake to Avoid?

I've seen it happen time and time again. The single biggest mistake new firm owners make is thinking that being a great lawyer is enough to make clients appear. It’s a fatal miscalculation. They’re brilliant legal minds, but they have absolutely no experience in marketing or sales.

The hard truth is that you have to be your firm's #1 rainmaker, starting on day one. If you're not actively and consistently doing things to bring in business, you're setting yourself up for failure. Neglecting business development is the fastest way to run out of cash.

To sidestep this trap, you need to get disciplined about it. Block off time in your calendar every single week—maybe it's every Friday morning—and dedicate it only to these kinds of activities:

- Networking: Show up at local business events. Take potential referral sources out for coffee.

- Content Creation: Write a quick blog post or record a simple video answering a question you get all the time from clients.

- Following Up: Check in with old contacts. Nurture the relationships you already have.

You have to treat marketing like a core part of your job, just as critical as drafting a motion or appearing in court.

Should I Specialize or Be a Generalist?

When you’re just starting out and need to pay the bills, it’s incredibly tempting to take any case that comes your way. It feels like the safe play. But trust me, positioning yourself as a "do-it-all" lawyer is a massive strategic mistake in the long run.

The real key to building a profitable, sustainable practice is to specialize in a clear, well-defined niche. When you specialize, you become the go-to expert. And when you're the expert, you can charge higher fees and attract better, more qualified clients who are looking for exactly what you offer.

Think about it from a marketing perspective. It’s much easier to market yourself as the "go-to lawyer for e-commerce startups" than just another "business lawyer." That kind of focus makes your message cut through the noise and resonate with your ideal audience. It also means you get much better referrals because people in your network know exactly who to send to you. Specialization is what builds a powerful brand and a predictable stream of clients.

Ready to build a modern, efficient practice from day one? Whisperit is the voice-first AI workspace designed for legal work, unifying dictation, drafting, and research to streamline your workflow. Move faster from intake to final document and deliver exceptional service to your clients. Learn more and see how it works at https://whisperit.ai.