How to Calculate Billable Hours Accurately

At its core, calculating what to bill a client is pretty straightforward. You just need to multiply the hours you spent on their work by your hourly rate.

It looks like this: Billable Hours × Hourly Rate = Total Amount Billed. Getting this simple calculation right is the first, most critical step toward sending accurate invoices and keeping your practice financially healthy.

The Foundation of Profitable Billing

Nailing your billable hour calculations is the bedrock of any successful service-based practice. It’s not just about making sure you get paid, either. It’s about clearly showing your value, building trust with your clients, and gaining a crystal-clear view of your own operations. This level of precision is what connects your hard work directly to a healthy bottom line.

Defining Billable vs Non-Billable Work

One of the first hurdles is learning to draw a clear line between what's billable and what's not. The reality is, not every minute of your workday can—or should—be charged to a client. Getting this right is fundamental to understanding your actual profitability and planning your resources effectively.

To put it simply, some tasks generate revenue, while others are the cost of doing business. Here’s a table to help clarify the difference:

| Activity Type | Description | Example |

|---|---|---|

| Billable Work | Any task performed directly for a specific client that moves their project or case forward. | Drafting a legal motion, conducting a patient consultation, researching case law, analyzing medical records. |

| Non-Billable Work | Essential activities for running your practice that are not tied to a single client's project. | Attending networking events, updating your website, administrative tasks like invoicing, internal team meetings. |

This separation isn't just for client billing; it also gives you a powerful lens into your team's efficiency. By understanding this split, you ensure clients only pay for the work that directly benefits them. Integrating this logic into your day-to-day is much easier with the right tools, as you can see in our guide on effective https://www.whisperit.ai/blog/practice-management-solutions.

The High Cost of "I'll Log It Later"

We've all been there. You finish a task and think, "I'll track that time later." But this is one of the most common ways practices leak revenue. The data is pretty stark: waiting until the end of the day can cause you to lose up to 10% of your billable hours. If you wait a full week? That number can jump to a staggering 50%.

This is exactly why a real-time tracking system isn’t just a nice-to-have—it's a core part of your financial stability. Those small, unrecorded tasks add up fast and directly eat into your profit margins.

While mastering time tracking is the first step, truly profitable billing also involves looking beyond the clock. It's worth exploring different revenue models, including innovative value-based pricing approaches, which can unlock new levels of profitability and client satisfaction.

Translating Minutes Into Billable Time

The real heart of any invoice is turning the time you’ve tracked into a clear, billable format. Instead of charging for every single second, most professionals group their time into standard chunks. This practice keeps things consistent and makes the math much simpler for you and your clients.

The most common way to do this is by converting minutes into decimal hours. All this means is that a portion of an hour is shown as a fraction—like 0.25 for 15 minutes. Getting this right is the key to creating invoices that are both accurate and easy for your clients to understand.

The Math Behind Billing Increments

The formula to turn your raw minutes into billable time is refreshingly simple:

(Total Minutes Worked ÷ 60) = Billable Decimal Hours

Let's say you spend 45 minutes drafting a detailed email to a client. The calculation is just 45 ÷ 60, which equals 0.75 billable hours. If your rate is $200** per hour, you’d bill **$150 for that task (0.75 x $200).

This approach removes any guesswork and makes sure every block of your time is accounted for systematically. It's the standard for a reason—it’s fair, transparent, and you can repeat it every time.

Choosing the Right Billing Increment

Different industries have settled on different standards for how they chunk their time. Your choice often comes down to finding the sweet spot between pinpoint accuracy and practical simplicity. Two of the most common intervals are the six-minute and 15-minute increments.

- Six-Minute Increments (0.1 Hours): This is the go-to in the legal world. Why? Because it lets you capture all those small but critical tasks. A quick two-minute phone call or a five-minute document review each get billed as 0.1 hours. This stops you from losing money on dozens of tiny tasks that really add up throughout the day.

- Fifteen-Minute Increments (0.25 Hours): You’ll often see consultants, creative professionals, and agencies using this method. It groups work into larger, quarter-hour blocks, which is sometimes simpler to manage and can feel more straightforward for clients.

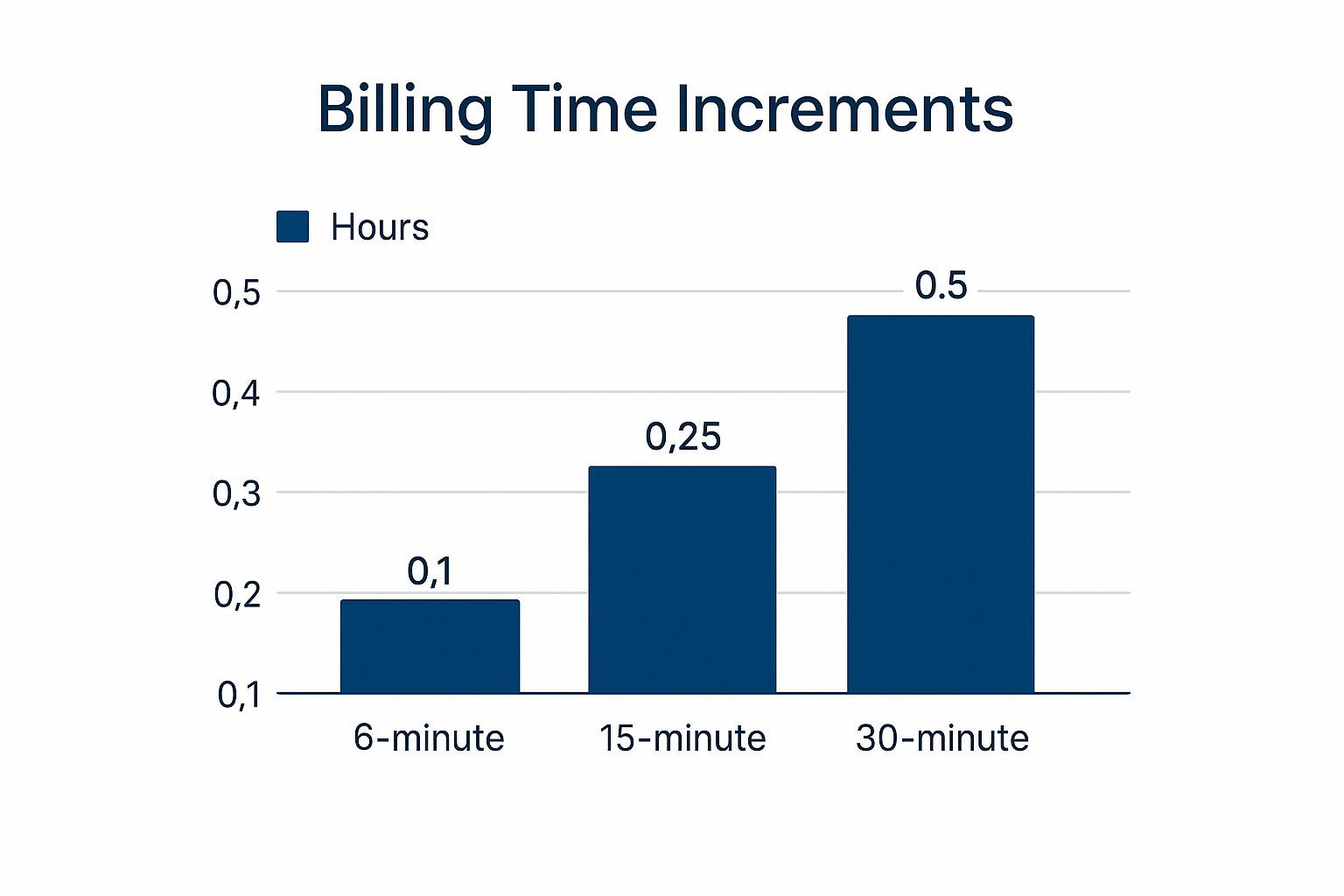

The infographic below breaks down how these different time increments translate into billable decimal hours.

As you can see, there’s a direct link between the minutes you work and the decimal you bill. It makes it much easier to visualize how different billing standards are applied in the real world.

Using a Conversion Chart for Speed and Accuracy

To make invoicing even faster, many pros keep a billable hours chart handy. Think of it as a cheat sheet that instantly converts your minutes into the correct billable decimal, so you don't have to pull out a calculator every time. For instance, a lawyer working for 15 minutes at $100** per hour would see that this converts to 0.3 hours (using the six-minute standard), resulting in a **$30 charge. You can learn more about how these charts help with legal billing in this insightful article from Clio.

To help you get started, here’s a quick-glance table showing how common minute-blocks convert into billable decimal hours.

Billable Hours Conversion Chart

| Minutes Worked | Decimal Hours (6-Min Increment) | Decimal Hours (15-Min Increment) |

|---|---|---|

| 1-6 | 0.1 | 0.25 |

| 7-12 | 0.2 | 0.25 |

| 13-15 | 0.3 | 0.25 |

| 16-18 | 0.3 | 0.50 |

| 25-30 | 0.5 | 0.50 |

| 45 | 0.8 | 0.75 |

| 60 | 1.0 | 1.00 |

This kind of chart is a huge time-saver and ensures your billing is always consistent, no matter how many small tasks you're juggling.

A Quick Tip from Experience: The billing increment you choose has a direct impact on your bottom line. A 6-minute interval is great for capturing granular work and can boost your revenue, while a 15-minute interval is simpler but might mean you're leaving money on the table. Whatever you choose, make sure it aligns with your industry’s norms and is spelled out clearly in your client agreements from day one.

Choosing Your Time Tracking Toolkit

The accuracy of your billable hour calculations hinges entirely on the quality of the data you put in. Choosing the right system to track your time isn't just an administrative task—it's a critical business decision that directly affects your revenue. The right tools can mean the difference between capturing every billable minute and watching valuable time (and money) slip through the cracks.

Many of us start with the basics: spreadsheets. They're accessible and everyone knows how to use them, but they’re completely dependent on manual entry. We've all been there—you forget to log that quick phone call at the end of a chaotic day, and just like that, revenue is lost. As your client load grows, this manual method becomes a real liability, making it nearly impossible to keep everything accurate and consistent.

Moving From Manual to Automated Systems

That’s why so many professionals eventually switch to dedicated time tracking software. These tools are built to solve the exact problems of manual tracking. Instead of trying to remember what you did hours ago, you can click a real-time timer when you start a task and stop it when you're done. Simple. This captures your time with down-to-the-second precision.

On top of that, these platforms offer features that give you a much clearer picture of your business:

- Project and Client Tagging: You can assign every time entry to a specific client, project, or task, which keeps records tidy and makes invoicing much faster.

- Seamless Invoicing: Many tools create professional invoices directly from your tracked hours, saving you from the headache of manually transferring all that data.

- Detailed Reporting: Get a clear breakdown of where your time is actually going. This is incredibly useful for spotting your most profitable clients or identifying tasks that are eating up too much non-billable time.

For professionals who want to go a step further, understanding the essential practice management software features can be a game-changer, as these systems often bundle time tracking with other core operational tools.

The Rise of AI-Powered Time Capture

The next big shift is toward AI-powered tools that take the manual work out of the equation entirely. Platforms like Whisperit are designed to intelligently capture your billable activity as it happens, drastically cutting down on administrative work. For example, Whisperit can automatically log the time you spend drafting a legal brief or composing an email to a client, all within its integrated workspace.

By automating the actual recording of your time, you essentially plug the leaks that let revenue escape. This shift frees you up to focus on what you do best: high-value, billable work.

Whisperit creates a unified environment where your work—from document creation to client communication—is captured seamlessly. This integrated approach ensures no billable moment gets lost in the shuffle.

Of course, the key is finding what works for you. It's worth exploring different productivity measurement tools to find the perfect fit for your workflow, whether you're a solo practitioner or part of a large firm. The goal is always to find a system that adapts to how you work, not the other way around.

How to Maximize Your Billable Utilization Rate

Knowing how to calculate your billable hours is one thing. But if you really want to gauge your firm's health and find opportunities for growth, you need to focus on your billable utilization rate.

This isn't just another piece of business jargon. It’s a critical KPI that measures your team's productivity and efficiency. Think of it this way: tracking raw hours is like counting the cars coming off your assembly line. The utilization rate tells you how often that assembly line is actually running. It’s a direct look at how well your team is converting its time into revenue.

Calculating Your Utilization Rate

The formula itself is pretty simple. Billable utilization is just the percentage of an employee's available hours that are spent on actual billable work. You can get into the weeds of how different firms measure this, but the core calculation is just dividing billable hours by total available hours, then multiplying by 100 to get a percentage. A well-run consulting firm, for instance, might aim for a utilization rate of 80%. More on that from the experts at Kantata.

Here's the math:

(Total Billable Hours ÷ Total Available Hours) × 100 = Utilization Rate (%)

Let's put that into a real-world context. Say a junior associate has 160 available work hours in a month. If they log 120 billable hours, their utilization rate is 75% (120 ÷ 160 × 100). That single number tells you a lot about their productivity.

Strategies to Boost Your Rate

A low utilization rate doesn't automatically mean your team is slacking off. Far from it. It usually points to bigger, systemic problems—too much administrative work, workflow bottlenecks, or unclear expectations. The goal isn't just to work more; it's to make the hours you already work count for more.

Here are a few things that have worked for countless firms:

- Define What's Billable (and What Isn't). Make sure everyone on your team has a crystal-clear understanding of what constitutes a billable task versus non-billable overhead. A simple cheat sheet or a quick team huddle can prevent valuable time from being written off.

- Cut Down on Administrative Drag. This is the big one. Admin work is the silent killer of productivity. It’s all the necessary but non-revenue-generating stuff like invoicing, scheduling, and paperwork that devours precious time.

- Set Attainable Goals. Don't aim for 100% utilization—that’s a recipe for burnout. A healthy target is typically in the 75-85% range. This leaves room for crucial non-billable activities like professional development, internal meetings, and business development.

The fastest way to see a jump in your utilization rate is to attack the administrative burden head-on. Every single hour you save on internal tasks is an hour that can be put toward client work, which flows directly to your bottom line.

One of the best ways to get those hours back is by automating repetitive tasks. When you let technology handle the non-billable grunt work, you empower your team to focus on what they were actually hired to do. Our guide on how to automate administrative tasks breaks down exactly how to find and eliminate these time-wasters.

For example, using a tool like Whisperit to automatically capture time spent drafting emails or on client calls ensures every billable moment is tracked—without creating more admin work in the process.

Common Billing Mistakes and How to Fix Them

Even if you’ve nailed your billing formula, costly mistakes can still creep in. These little slip-ups, usually born from a hectic day and old manual habits, can snowball into serious lost revenue and damage the trust you’ve built with your clients.

Let's walk through some of the most common tripwires I've seen over the years. By spotting these pitfalls early, you can build a more bulletproof billing process that protects your bottom line and your reputation.

Forgetting to Log Small Tasks

This is probably the biggest offender. That quick five-minute phone call, a three-minute email to clarify a detail, or a brief document review—they all seem too small to bother logging at the moment. But they add up, and fast.

Over a week, dozens of these tiny, unbilled tasks can easily turn into several hours of work you’ve given away for free. This is a perfect example of revenue leakage, where your hard work isn't reflected on the final bill.

The Fix: Make real-time tracking your new best habit. I always recommend using a tool with a simple start-stop timer. When you capture time as it happens, you make sure even the smallest tasks are accounted for. It's fair to you and fair to the client.

Providing Vague Invoice Descriptions

Your clients need to know exactly what they’re paying for. An invoice with a line item that just says "Research" or "Client Communication" is a recipe for confusion and payment delays. It immediately raises questions and makes clients wonder what’s behind the curtain.

Clear, detailed descriptions are your best friend here. They show the value you delivered and justify every minute you spent, turning your invoice into a progress report your client can actually understand.

Try this simple switch for every entry:

- Instead of "Research," try: "Researched precedents related to Section 3B of the contract."

- Instead of "Client Call," try: "12-minute call with client to confirm key project deadlines and deliverables."

This isn't just for your client's benefit; it also creates a much better internal record of your work. You're building accountability and leaving no room for doubt, which is what strong professional relationships are built on.

Inconsistent Time Tracking Practices

Another classic mistake is being diligent with time tracking one day and then trying to piece it all together from memory the next. It’s tempting, especially at the end of a long week, but it’s a terribly inaccurate way to work. You'll almost always under-bill yourself.

On top of that, manual data entry is a minefield for typos and other simple errors that can throw your records off completely. If you want to dive deeper into this, we have a whole guide on how to avoid data entry errors.

The solution is simple: commit to one system. An automated platform like Whisperit is designed for this exact problem. It captures your billable work as you go, taking the guesswork out of the equation and ensuring every entry is consistent and accurate.

Billable Hours FAQs: Your Top Questions Answered

Even when you have a good system, the day-to-day reality of tracking time brings up some tricky questions. These are the practical, in-the-weeds issues that can make or break your billing accuracy. Let's tackle some of the most common ones I hear from professionals.

What's the Best Billing Increment to Use?

Honestly, there's no single "best" answer—it really comes down to your industry and what you've agreed on with your client. For instance, law firms have long used six-minute (0.1 hour) increments. This lets them capture value from quick but important tasks, like a short phone call or a brief email review, that would otherwise go unbilled.

On the other hand, consultants and creative agencies often find 15-minute (0.25 hour) increments are a better fit for their project-based work, feeling less nit-picky. The most crucial thing is to pick a standard, be consistent, and spell it out clearly in your contracts. Transparency is everything here.

How Should I Bill for Client Communication?

This is a classic gray area that trips up a lot of people. A quick "thanks!" email? That's just overhead. But any communication that actively pushes a project forward is absolutely billable work. This means scheduled calls, strategic email exchanges, and the time you spend drafting detailed feedback are all fair game.

The best advice I can give is to eliminate the guesswork from day one. Your service agreement should explicitly state that substantive communication is billable. This sets expectations early and helps you avoid awkward billing disputes later on.

Should I Bill for My Travel Time?

Billing for travel is a standard practice, but you have to be completely upfront about it. The policies can vary a lot. Some professionals bill their full hourly rate, while others charge a reduced rate, maybe 50%, for time spent on the road or in the air. The key is to have a clear policy and apply it consistently.

Make sure this is spelled out in your client agreement. Get specific about what counts as billable travel (like driving to their office for a mandatory meeting) versus what's just your regular, non-billable commute.

How Can I Accurately Track Time Across Multiple Clients?

Juggling several clients is where manual time tracking completely falls apart. Trying to remember every five-minute task at the end of a long day is a recipe for lost revenue. This is precisely why using a dedicated time-tracking tool with a real-time timer is non-negotiable for serious professionals.

The process is simple but incredibly effective:

- Start a timer assigned to a specific client and project the moment you begin the task.

- When you switch gears to work for someone else, just stop the first timer and start a new one for the next client.

This simple habit stops those valuable minutes from vanishing and ensures every client is billed accurately for the work you've done. It's a fundamental part of good time management, which you can read more about in our guide on expert strategies for productivity.

Stop losing revenue to unrecorded work and administrative headaches. Whisperit is the voice-first AI workspace that unifies your drafting, research, and collaboration, automatically capturing your billable activity as you work. See how it transforms your workflow at https://whisperit.ai.