Explore due diligence software for streamlined legal and compliance workflows

At its core, due diligence software is a tool designed to bring order to chaos. It automates the tedious work of collecting, analyzing, and reporting on vast amounts of data. For legal and compliance teams, this means identifying risks in M&A deals, KYC checks, and third-party vetting far more efficiently than any manual process could ever allow.

The software replaces slow, error-prone manual reviews with a central, intelligent platform, paving the way for faster, smarter, and more accurate decisions.

Why Manual Reviews No Longer Work

Imagine trying to navigate a sprawling, modern city with nothing but a folded paper map from a decade ago. It might show you the main roads, but it’s completely blind to new highways, real-time traffic jams, and unexpected construction detours. This is precisely the challenge legal and compliance teams face when they rely on manual due diligence.

The old way—endless spreadsheets, scattered emails, and stacks of physical documents—simply can't keep up. These methods are slow, riddled with opportunities for human error, and ultimately paint an incomplete and often outdated picture of risk.

The Shift to Automated Workflows

Moving to due diligence software isn't just a nice-to-have upgrade; it's a strategic necessity. A single M&A deal can easily involve thousands of contracts, financial statements, and HR files. Trying to manage a manual document review process on that scale is a recipe for missed deadlines and overlooked risks.

This move toward automation is all about gaining a critical advantage. Specialized software gives teams the power to:

- Accelerate Timelines: Pull data from thousands of sources in minutes, not weeks.

- Enhance Accuracy: Let AI spot risks and flag clauses that a tired human reviewer might miss.

- Create Defensible Audits: Generate a secure, time-stamped record of every single action.

- Improve Collaboration: Centralize all findings in one place for every stakeholder to access.

The shift from occasional, human-only reviews to continuous, software-driven monitoring is more than a trend—it's a fundamental change in how risk is managed. It allows teams to get ahead of problems instead of just reacting to them.

To see just how different the two approaches are, let's break it down.

Traditional vs. Software-Driven Due Diligence

| Aspect | Traditional (Manual) Approach | Software-Driven Approach |

|---|---|---|

| Process | Disjointed and siloed (spreadsheets, emails, shared drives) | Centralized platform with integrated workflows |

| Speed | Weeks or months, limited by human capacity | Hours or days, depending on data volume |

| Accuracy | High risk of human error, fatigue, and inconsistency | AI-powered analysis reduces errors and biases |

| Scalability | Extremely difficult to scale; more data requires more people | Easily scales to handle massive data volumes |

| Audit Trail | Fragmented and difficult to reconstruct | Automated, time-stamped, and tamper-proof |

The contrast is clear. While manual methods get the job done eventually, they introduce significant risks and inefficiencies that modern software completely eliminates.

Responding to a Growing Market Need

The demand for better tools is exploding. Between 2024 and 2034, the market for enhanced due diligence software is projected to rocket from USD 3.20 billion to USD 10.08 billion, making it one of the fastest-growing segments in compliance tech. According to insights from Polaris Market Research, this surge is driven by vendors embedding AI-assisted document review and automated risk scoring to help companies meet rising regulatory pressures.

Ultimately, adopting due diligence software is like swapping that old paper map for a real-time GPS. You get a dynamic, complete view of the terrain, complete with live data and the fastest, safest route to your destination. It gives teams in legal, finance, and healthcare the confidence and precision needed to navigate today's complex deals.

The Core Features of a Modern Due Diligence Platform

What really separates a dedicated due diligence software platform from a glorified cloud storage folder? The difference lies in a handful of intelligent features built to cut through the noise, automate the grunt work, and spot risks a human reviewer might easily overlook. These are the engines that make modern due diligence fast, accurate, and defensible.

Think of it this way: a basic file-sharing system is like a massive library with no card catalog. The information is technically all there, but finding a specific fact is a nightmare. A true due diligence platform is your expert research librarian, who not only finds the right books but opens them to the exact pages you need to see.

Automated Data Gathering and Screening

The first headache in any due diligence project is just collecting the information. It’s often scattered across dozens of disconnected, external sources. Manually checking global watchlists, sanctions lists, corporate registries, and news archives for a single company can take hours. For a portfolio of hundreds of third parties? Forget about it.

This is where automated data aggregation makes all the difference. These platforms plug directly into hundreds of global data sources through APIs, doing the legwork for you.

- Global Watchlists: Instantly check individuals and companies against critical databases like OFAC, Interpol, and other international sanctions lists.

- Corporate Registries: Verify a company’s legal standing, ownership structure, and list of directors without having to navigate a dozen clunky government websites.

- Adverse Media Checks: The software scours thousands of news sites and public records for any sign of negative press, past litigation, or other reputational red flags.

With one search, the platform pulls everything together into a single, clean risk profile. It does in minutes what it would take a team days to accomplish manually.

AI-Powered Document Analysis

Once all the documents are in one place, the real work begins. A typical M&A data room can hold thousands of contracts, and each one can be a dense, hundred-page monster. Reading every single line to find specific problematic clauses is an exhausting task, and the risk of missing something due to simple fatigue is enormous.

This is where modern due diligence software brings in Artificial Intelligence—specifically Natural Language Processing (NLP)—to read and make sense of these documents at an incredible speed.

AI isn't here to replace the legal expert; it's here to supercharge them. It acts like a tireless junior associate who reads every word of every document, flagging potential issues so senior team members can apply their strategic expertise where it truly counts.

Imagine you're handling an acquisition and need to find every single contract that's missing a specific data privacy or change-of-control clause. Instead of assigning a team to read for weeks, an AI can scan the entire document set and give you a complete list in less than an hour. This kind of power is a core component of any modern AI contract management system, transforming a slow, reactive chore into a fast, proactive advantage.

Customizable Risk Scoring and Reporting

Let's be honest: not all risks are created equal. A minor compliance footnote in one country could be a massive deal-breaker in another. The best due diligence software moves beyond simple "pass/fail" results and gives you customizable risk scoring.

Your team can set its own risk tolerance, weighing different factors based on the deal, the client, or the industry. For example, a link to a politically exposed person (PEP) might be a high-risk flag for a bank, but a much lower concern for a manufacturing company. The software applies these custom rules automatically, calculates a score, and flags any entity that crosses the thresholds you’ve set.

This all flows into much smarter reporting. Instead of dumping a mountain of raw data on your stakeholders, the platform creates clean, easy-to-read summaries that put the most critical risks front and center. Crucially, these reports come with a clear, defensible audit trail that shows every check that was run and every decision that was made, creating a bulletproof record for any regulator who comes knocking.

How Software Actually Changes the Game for Legal and Compliance Teams

It’s one thing to read a list of software features, but it's another thing entirely to see how they come together to untangle a real-world legal process. Let's walk through a hypothetical M&A deal to see how a dedicated platform can turn a chaotic, multi-front battle into a controlled, efficient operation.

The whole thing kicks off the second a potential target company is on the radar. In the old days, this meant a flurry of emails, assigning manual searches, and a whole lot of waiting. Now, the lead counsel just types the target's name into their due diligence software.

Almost immediately, the platform's data aggregation engine gets to work, pulling information from global watchlists, corporate registries, and news sources. Instead of waiting days for a junior associate to cobble together a preliminary report, the team gets a high-level risk profile in minutes. This allows for a quick, data-driven "go" or "no-go" decision right at the outset.

From a Quick Look to a Deep Dive

Once the initial background check gives the green light, the real work begins. The target company starts uploading thousands of documents—contracts, financials, intellectual property filings—into a secure digital data room. This is the exact point where the old manual process would bog down for weeks, if not months.

But with modern software, this is where the AI takes over. The legal team can set up custom rules to automatically flag contracts with unusual liability clauses, find agreements that are missing critical change-of-control provisions, or identify terms that clash with industry regulations. The AI isn't just doing a simple keyword search; it understands legal context, which dramatically cuts down on false positives and saves hundreds of hours of mind-numbing manual review.

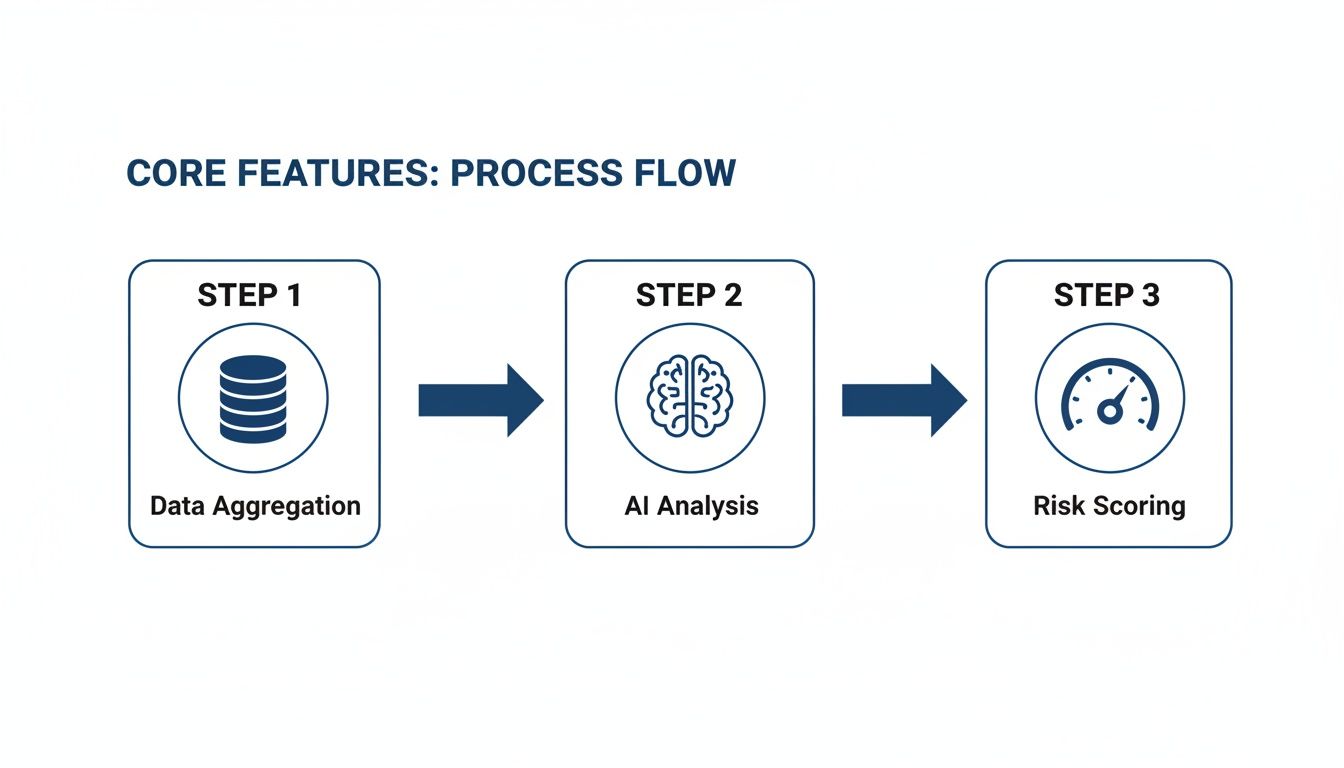

This diagram shows how these core functions—pulling data, analyzing it with AI, and scoring the risk—create a powerful, continuous loop.

As you can see, each step feeds intelligence into the next. The workflow gets smarter as it goes, constantly enriching and re-evaluating the data.

Keeping Everyone on the Same Page

As the analysis moves forward, the team can talk to each other right inside the platform. No more digging through endless email chains to find that one question someone asked last Tuesday. A paralegal can simply tag a senior associate on a specific clause within a document, and the entire conversation is logged right there, in context.

This creates a single source of truth, which is absolutely invaluable. Every action, question, and finding is captured in an unchangeable audit trail. This is a core component of modern legal workflow automation software because it makes the entire due diligence process completely defensible.

When it's time to create the final report for the partners or the client, nobody has to manually pull together findings from a dozen different spreadsheets. With a few clicks, the software compiles all the flagged risks, AI insights, and team comments into a polished, comprehensive report. A task that used to be a week-long, caffeine-fueled nightmare is now done in minutes.

By bringing data collection, analysis, collaboration, and reporting under one roof, due diligence software turns a series of separate, frustrating tasks into a single, cohesive workflow. It gets rid of redundant work and ensures the entire team is working from the same playbook.

And this model isn't just for M&A. To see how a wider range of tools help with regulatory hurdles, it's worth checking out reviews of the top banking compliance software solutions. These platforms use the same principles of automation and centralization to solve very specific industry challenges, showing just how versatile this approach can be.

From that first name search to the final signature on the deal, the software becomes the team's central command. It transforms a scattered, high-stress process into a structured, confident, and collaborative one. It truly changes how legal and compliance work gets done.

Meeting Critical Security and Data Privacy Requirements

When you're in the thick of a high-stakes deal, handling incredibly sensitive corporate data, security isn't just another box to check—it’s the entire foundation of your process. Think of choosing a due diligence software platform like choosing a vault for your company's crown jewels. You wouldn't pick one with a flimsy lock, and the same thinking applies here. Your chosen platform has to be built to handle modern cyber threats and meet a maze of global regulations.

This means you have to look past the marketing promises and get into the weeds of their security protocols. For professionals in legal, finance, or healthcare, data confidentiality is everything. Understanding exactly how your information is being protected is non-negotiable.

The Anatomy of a Secure Platform

A genuinely secure platform isn’t just about having one strong wall; it's about having multiple, overlapping layers of defense. It all starts with the basics, like end-to-end encryption. This is what makes your data completely unreadable, whether it's just sitting on a server (at rest) or flying across the internet (in transit).

Beyond that, the best platforms give you precise control over who can see what and when. That’s where role-based access controls (RBAC) come in. You can give your core legal team full editing rights, grant an external advisor read-only access, and completely block others. It ensures sensitive files are only ever seen by those who absolutely need to.

- Data Residency and Sovereignty: Do you know where your data actually lives? For any organization dealing with GDPR, CCPA, or similar regional laws, the ability to store data within a specific geography (like the EU or the US) isn't a nice-to-have; it's a legal must.

- Immutable Audit Trails: A secure system should log every single action. We’re talking every file view, every download, every comment, and every change, all captured in a time-stamped record that can’t be altered. This creates a bulletproof history of the entire diligence process.

Verifying a Vendor's Security Posture

So, how can you be sure a vendor is actually walking the walk on security? Look for independent, third-party certifications. These aren't just fancy badges for their website; they represent rigorous, ongoing audits of a company's security controls and day-to-day practices.

SOC 2 and ISO 27001 certifications are the gold standard. They offer objective proof that a vendor has implemented comprehensive security policies and has the necessary controls in place to protect your data from cyber threats and unauthorized access.

The image below shows what a truly comprehensive security framework looks like in practice.

This kind of validated security shows a real commitment to protecting your most valuable information. You can see how these principles apply to your own internal processes by reading our guide on conducting a https://www.whisperit.ai/blog/data-privacy-impact-assessment.

Responding to Heightened Industry Threats

The need for this kind of ironclad security has never been more pressing, especially for heavily targeted industries. The financial services sector, for instance, is projected to face about 33% of all AI-powered cyberattacks in 2025, making it the most vulnerable of all.

As a result, regulators are cracking down. They’re now demanding real-time monitoring and defensible, time-stamped reports as a prerequisite for any major partnership. This pressure means you need software that not only secures your data but can also prove its compliance at a moment's notice. Often, this also means having integrated features like secure PDF redaction tools to properly scrub personally identifiable information (PII) before documents are shared.

A Practical Checklist for Choosing the Right Software

Picking the right due diligence software isn’t about chasing the platform with the longest feature list. It’s about finding the one that actually solves your team’s problems. Choosing poorly can lead to a very expensive, very frustrating implementation failure that nobody wants to own.

This checklist will walk you through a more strategic way to evaluate your options. We'll break it down into four key areas to help you look past the price tag and find a tool that genuinely fits your workflow and delivers real value for years to come.

Assess the Functional Fit for Your Needs

Before you even look at a demo, you need a crystal-clear picture of what you'll be using the software for. A law firm handling massive M&A deals has completely different needs than a bank running rapid-fire KYC and AML checks. The perfect tool for one is almost certainly the wrong tool for the other.

- Task-Specific Workflows: Does the software come with ready-made templates or workflows for your bread-and-butter tasks? Think third-party risk management, M&A due diligence, or contract review.

- AI and Analytics Capabilities: Get under the hood of the AI. Is it just a glorified document scanner, or can it pinpoint specific clauses, sentiment, and risks that are truly relevant to your industry?

- Reporting and Visualization: How easy is it to build reports that actually mean something to stakeholders and regulators? A flashy dashboard is worthless if it can’t communicate key findings in a simple, actionable format.

Evaluate Integration Power and Existing Systems

Your new software has to play nice with the tools your team already lives in every day. If it can’t connect seamlessly to your document management system (DMS), email client, or CRM, you’re just creating another data silo. This forces everyone into clunky, manual workarounds, which completely defeats the purpose of getting a new tool in the first place.

A truly integrated platform acts as a central hub, not another isolated island of data. The goal is to create a unified workflow where information flows freely between systems, eliminating redundant data entry and manual errors.

Don't be shy about asking vendors direct questions. Ask about their API capabilities and if they have proven, out-of-the-box integrations with the core software your firm relies on. Strong integration is a hallmark of the best compliance management tools because it ensures everyone is working from a single source of truth.

Plan for Scalability and Future Growth

The solution you pick today has to work for the organization you'll be tomorrow. A platform that's great for a small team reviewing a few deals a quarter might completely fall apart when faced with enterprise-level data volumes or a rapidly expanding compliance program.

Think about these points:

- Performance Under Load: How does the platform perform with genuinely massive data sets? Ask for real-world case studies or performance benchmarks, not just marketing claims.

- User and Project Growth: Look closely at the pricing model. Will adding more users or projects lead to predictable costs, or will you be hit with surprise fees?

- Feature Roadmap: What's the vendor's long-term vision? You want to see a clear plan for future development that aligns with where your industry and your organization are headed.

Analyze Vendor Support and Partnership

Finally, remember you’re not just buying a piece of software—you’re starting a long-term relationship. The quality of a vendor’s support can be the difference between a smooth rollout and a total disaster.

Look for a vendor that feels more like a partner. They should offer solid training, responsive technical support, and even strategic advice to help you get the most out of your investment.

Due Diligence Software Evaluation Matrix

To help you compare vendors side-by-side, we've put together a simple evaluation matrix. Use it to score each potential solution objectively based on what matters most to your team.

| Evaluation Criteria | Vendor A Score (1-5) | Vendor B Score (1-5) | Key Considerations |

|---|---|---|---|

| Functional Fit & Workflows | How well does it match our primary use cases (e.g., M&A, KYC)? | ||

| AI & Analytics Quality | Is the AI industry-specific or generic? Does it find relevant risks? | ||

| Integration Capabilities | Does it connect with our DMS, CRM, and other essential tools? | ||

| Ease of Use & UI | Can our team learn and adopt it without extensive training? | ||

| Scalability & Performance | Can it handle our projected data and user growth? | ||

| Reporting & Dashboards | Are reports customizable and easy for stakeholders to understand? | ||

| Vendor Support & Training | Is the support team responsive, knowledgeable, and helpful? | ||

| Total Cost of Ownership | What are the full costs beyond the license fee (implementation, training)? |

This matrix provides a structured way to move beyond gut feelings and make a data-driven decision, ensuring the software you choose is a true asset to your organization.

Best Practices for Successful Software Implementation

Choosing the right due diligence software feels like a major victory, but it's really just the first leg of the race. The real return on your investment comes from successful adoption—when the new platform becomes an indispensable part of your team's daily rhythm. This isn't just about flipping a switch on new tech; it's about leading a genuine improvement in how your team works.

Think of it like getting a high-performance engine for a race car. The engine has incredible potential, but it won't win anything until it's properly installed, fine-tuned, and the driver knows exactly how to handle it. The same logic applies here.

Start with a Focused Pilot Project

Instead of trying to boil the ocean with a firm-wide, big-bang rollout, start small. A focused pilot project minimizes disruption and gives you a controlled environment to prove the software's value. Pick a single team or a specific, high-impact task, like screening a new batch of third-party vendors or running a small M&A deal through the system.

A successful pilot builds incredible momentum. It creates internal champions who can vouch for the new process, making the broader rollout much smoother. It also gives you a chance to iron out any kinks on a much smaller, manageable scale.

Secure Executive Buy-In and Sponsorship

For any new tool to truly stick, you need a champion in the leadership suite. An executive sponsor does more than just sign off on the budget; they actively advocate for the change and communicate why it matters to the entire organization.

Successful implementation is driven by a clear vision from the top. When leaders frame the new software not as a mere tool, but as a strategic asset for managing risk and driving efficiency, teams are far more likely to embrace it.

This top-down support is crucial for pushing past inertia and making sure the project gets the resources it needs. It sends a clear signal that this is a priority, not just another piece of software.

Plan for Data Migration and Comprehensive Training

Your team’s existing data is a goldmine, so you need a solid plan for moving it. Work with your vendor to map out exactly how information from old systems, spreadsheets, and documents will be imported into the new platform. A clean, organized transfer from the start prevents a world of headaches down the road.

At the same time, build a training plan that goes beyond a single one-hour webinar. To be effective, training should be:

- Role-Based: Show users the features that are most relevant to their specific jobs. An analyst needs different training than a compliance manager.

- Ongoing: Offer follow-up sessions, office hours, and create a resource library for new hires.

- Hands-On: Get people into the software using practical, real-world examples.

This focus on getting adoption right is more critical than ever as the market for these tools grows. The audit management software market is projected to expand from USD 2.2 billion in 2026 to USD 6.0 billion by 2033, showing just how much demand there is for better tools. You can learn more about these market dynamics to understand why picking a future-proof platform and implementing it well is so important.

Your Questions About Due Diligence Software, Answered

Let's be honest, diving into a new piece of legal tech can feel overwhelming. When the tool in question is as critical as due diligence software, you need straight answers before you even think about making a move. We've gathered some of the most common questions legal and compliance teams ask and answered them directly.

Think of this as a practical, no-fluff guide to understanding how this technology really works and if it's the right fit for your team.

How Does the AI Actually Work in These Tools?

It’s less about a robot lawyer and more about a super-powered paralegal. The AI, typically driven by Natural Language Processing (NLP), is trained to read and understand legal documents at a scale no human ever could. It’s like having an assistant who can sift through thousands of pages in minutes without needing a coffee break.

So, instead of a lawyer manually combing through contracts with a search bar, the AI scans everything at once. It can instantly pinpoint key clauses, names, dates, and—most importantly—potential red flags based on the rules you set. For example, you can tell it to flag every contract that lacks a change-of-control provision or contains an unusual liability clause, and it will serve them up on a silver platter.

The point isn’t to replace human lawyers, but to amplify their expertise. The AI does the grunt work—the initial, time-sucking review—so legal professionals can dedicate their brainpower to strategic analysis of the high-risk items the software has already found. It’s about saving massive amounts of time and cutting down on the risk of human error.

Can This Software Plug Into the Systems We Already Use?

Yes, and it absolutely should. Any modern due diligence platform worth its salt is built to play nice with your existing tech stack. Through something called an Application Programming Interface (API), these tools can connect seamlessly with the systems you rely on daily, like your Document Management System (DMS), CRM, or even your email.

This creates a single, unified workflow where information moves smoothly from one system to another. It breaks down those frustrating data silos and turns your due diligence process into a connected, efficient part of your firm’s operations instead of a standalone headache.

Is Due Diligence Software Just for Big-Shot Firms?

Not anymore. It’s true that large, global firms were the first ones on the scene, but the landscape has completely changed. The rise of cloud-based, Software-as-a-Service (SaaS) solutions has been a game-changer.

Today's platforms offer flexible, scalable pricing models that put powerful due diligence software within reach for smaller firms and in-house legal teams. You don't have to sink a fortune into on-site servers or lock into a massive contract. By finding a tool that fits your team's size and specific needs, even a small team can get the same efficiency boosts and risk-reduction benefits that were once reserved for the industry giants. It really has leveled the playing field.

Whisperit is the voice-first AI workspace built to unify dictation, drafting, research, and collaboration for legal teams. It helps you move from client intake to final export in fewer steps, all within a secure, integrated environment. See how it works.